Fednow vs ach: an overview

FedNow Service is providing a new instant payment processor backed by the Federal Reserve that allows small to large businesses to send payments through the United States with safety measures on security, low processing fees, and overall easier business operations finally catching up to the new technology.

However the release of FedNow has brought questions regarding other famous applications such as Zelle, Cashapp, Venmo and, ACH. Will the release of FedNow in July 2023 cause a decrease of users in those popular apps? Is FedNow such a good alternative that there is no reason to opt out for others, is FedNow not comparable? Let’s take a closer look at what distinguishes FedNow from ACH and other top payment transaction applications.

Key Takeaways

- FedNow is a payment processor developed by the Federal Reserve.

- The transaction speed and costs are said to be not only quicker than competitors but also with little to no fees.

- FedNow service is mainly towards small to large institution creating easier business operations.

- More than 100 large organizations including Citi, Capital One, and Jp Morgan Chase had adapted to this processor.

What is FedNow

FedNow a new real-time payment service was announced in May 2021, and is set to release next month in July 2023 creating a new path to assist institutions all around the world. Creating a much easier convenience for salary payments to be distributed to employees with no delayed payroll payments but instant. This new phenomenon enables customers to send and receive money within seconds, 24/7 through the most popular banks and credit unions.

You can complete your payments whenever you like, where ever you like, there is nothing stopping you, from holidays, weekends and even after business hours, you are now accessible to send payments and transactions whenever you like. FedNow is the first U.S government-backed and created project meaning it has high security protecting the everyday user, instead of some corporation that has to be monitored closely by the SEC. It is true that the Federal Reserve already has a payment portal but it’s heavily outdated and does not operate to 2020 standards, unlike Venmo, and Cash App.

FedNow Release Date?

FedNow was announced earlier this year in the month of March, and the full release of this payment processor will take place in July 2023. The launch will be very successful because it is confirmed that over 120 large well known banks will be committed to joining and utilizing this application right from its release on day one.

Like any similar application, it is important to realize that softwares such as these are not perfect in day one. However, we can expect improvements through regular updates, ensuring that its up to date. It is great to witness such an amazing start, by offering lower costs, faster transaction speed, and 24/7 operation. This sets a solid foundation and i’d love to see how much better it can become through time.

Transfer Speed:

In today’s world, we have all experienced the delays of depositing a paycheck, or even initiating a wire transfer. We can also experience certain scenarios that causes it to take even longer such as, holidays, natural disasters, and weekends. This can cause us a headache but mostly who likes waiting for “1 to 3 business days: messages, because I know I don’t.

We are in an era where most common apps such as Zelle, Cash-App and Venmo are practically instant with no fees, so why has the Federal Reserve taken so long to adapt?

FedNow defines the go to application for transfer speed. Receiving funds instant, in the blink of an eye without ever expecting a message telling you it may take 1 to 3 business days.

Costs of utilization

As we are all aware, nothing in this world comes free. Someone, somewhere has to cover the costs. From paying the employees, to the advertising and more. So that being said FedNow, will be incorporating fees for every transaction that takes place. Let’s dive into the specific fees you can expect to be paying coming forward.

Customer Credit Transfer will be topped at $0.045 per item. PACS.008

Customer Credit Transfer Returns will also be topped at $0.045 per item. PAC.004

Liquidity Management Transfer or known as (LMT) will have a fee of $1.00 per item under PACS.009

The Requests for Payments also fall for a fee which comes out to $0.01 per item. PAIN.013

FedNow also incorporates a participation Fee, which comes out to be free.

The costs are set to be cheaper then competitors but not by much, however it is said that few banks will cover the fees themselves. The FedNow real-time payment will create clearer functionality while coming at no costs.

Amount Limits:

The Federal Reserve are taking a cautious approach due to precautions that may occur due it being a new release. To ensure the utmost safety to prevent fraudulent activities they’ve capped the transfer limit up to $500,000, with a base limit set at $100,000. This decision aims to prevent institutions from engaging in fraudulent practices, however FedNow will expect an increase after months of operation.

Unfortunate Limits:

FedNow will initially be limited to United States customers exclusively between U.S financial institutions throughout 2023 and possibly 2024. If you need to make overseas transactions, it still recommended to use the most common ways such as wire transfers through your bank or money transfers. For long term travelers it is best to continue using multi currency accounts to handle cross transactions. As of right now FedNow is mostly US base and soon in future will be implemented for domestic use.

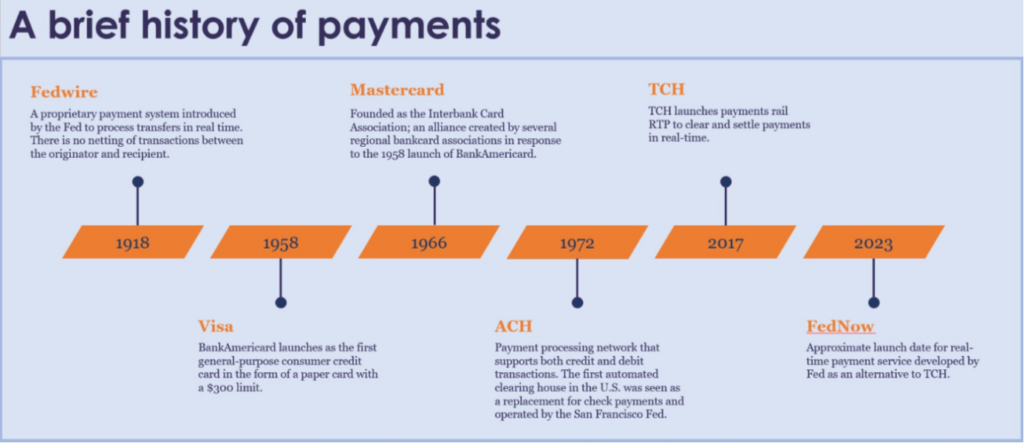

Will FedNow replace ACH?

No, Fednow will not be replacing the use of (ACH) or also known as Automated Clearing House Network, however the use of FedNow will assist ACH to work quicker and more efficents.

ACH is also a U.S- based funds transfer for consumers, businesses, and federal use. It is mostly used to send direct deposits, and direct payment to participants. ACH being the most known way to send transactions also takes around one to three business days to complete.

Many thought that the Federal Reserve will simply improve ACH instead of creating a new software, but that is not the case. But once again FedNow is established to be the better service than ACH but wont totally replace it because FedNow does not operate through the entire world but only the United States.

Mobile banking compatibility

FedNow has a great feature that just may make you become a user. The feature allows you to make deposits as well as manage your accounts on your devices. FedNow will be using simple and adaptive forms of communication known as (SOAP) to enable these features. Through this new type of feature , financial institutions can allow customers to use their devices to perform transactions through mobile apps.

Also giving you the opportunity to deposit or cash a check from the comfort of your home. This feature is a overall game changer to convenience. Also becoming useful for banks and credit union.

Fraud Protection in depth

In 2023, fraud remains to continue grow creating a significant concern, even within the most popular and used regulated applications such as Zelle. Despite how popular the apps may be, the fraud continues to increase due to hackers knowing the secret ropes to bypass security. According to warren Office, the reported amount of fraud through one popular application “Zelle” alone was over $400 million dollars in 2021, and it continues to increase every year.

FedNow has implemented high tech measure to combat fraud, making sure you have the highest security that you deserve. These solutions aim to create a stress free environment whenever transfering funds. Here are the key features on how this application with attack fraud.

- Authentication: FedNow incorporates much difficult authentication methods that can not get bypassed by an AI or robots to ensure that only authorized real users could sign in. Reducing the risk of unauthorized activity.

- Live Monitoring: This new system had employed a system where actions are monitored to detect suspicious patterns or behaviors in real time, and than will contact you to confirm it’s you and to be sure what is occuring.

- Fraud Detection: This payment processor has a top algorithm designed to detect and flag fraudulent transaction immediately. Analyzing factors such as transaction history, behavior patterns once again and overall detects fraudulent activities.

- Encryption Secured: Data that is ran through FedNow is encrypted by computer security protocols. Making sure that all your sensitive information stays secured and not accessible to unauthorized individuals.

- Financial Institutions collabs: The greatest part to ensure safety is the collaborates with large companies such as JP Chase Morgan, Wells Fargo, and law enforcement agencies with top level experts, all companies working together to strengthen the security in FedNow.

How will this effect crypto?

There has been many questions surrounding whether FedNow is a faster and safer alternative to cryptocurrencies such as Ripple (XRP) and Bitcoin (BTC). As a passionate crypto enthusiast since 2017, I believe both FedNow and cryptocurrencies are both great options. However when considering the differences between the two, FedNow is the better alternative to speed,safety and overall capability. The better alternative about cryptocurrency is the possibility of not being tracked on where your currency is going to allowing total freedom.

FedNow provides instant payment through real time, and ensuring the quickest transaction speed to little fees as compared to common cryptos such as bitcoin. Fees can not be adjusted due to demand and mining such as cryptocurrencies.

If we talk about safety, FedNow once again is better than cryptocurrency, according to Gov websites an estimate of $2.57 billion dollars had been stolen from fraud through cryptocurrency in 2021. With the new security features in FedNow makes them a way safer route to handle your transaction through.

While cryptocurrencies such as Monero and Zcash offers untraceable transactions, they may still face challenges for the reasons above. If you’re looking for a way to not be tracked through your transactions than cryptocurrency might be your way to go, however if you don’t mind government control and high security than use FedNow.

Benefits of using FedNow?

- Main benefits of using this application is instant payment, and the best top notched security due to federal oversight. Uses (RTGS) to ensure payments to happen in a instant through banks,

Who can use Fednow?

- The purpose is designed mostly for financial institutions from small to large ones. However you’re allowed to access and use it for daily transactions.

Is Fednow free?

The Federal Reserve has announced the fee’s and it is shown to be small and it is said to be covered by the large institutional banks. However nothing is set stone just yet until the release this July 2023.

Which companies are joining?

Here are a list of the most notable participants that will be using FedNow.

- JPMorgan Chase

- Bank of America

- Citigroup

- Wells Fargo

- PNC Financial Services Group

- U.S Bank

- Truist Financial Corporation

- Fifth Third Banj

- KeyBank

- First Horizon Bank

To conclude

In conclusion, FedNow is an upcoming payment application scheduled to release in July 2023, after three years in development it is finally here. Aiming to address the most common issues that most individuals face, sending payments, cashing checks, and security. We had also discussed the main differences between them and other popular applications such as Zelle, Cash-App and Venmo. Also the differences between the famous cryptocurrency projects such as Ripple (XRP) and Bitcoin (BTC). Their is a bright future for this new payment processor, and will become a leading solution for many. We Hope this article has provided informative content to help you have a deeper understanding of the differences between FedNow and ACH.